Central banks play a vital role in the forex market, influencing exchange rates, stabilizing economies, and ensuring financial order. In this comprehensive guide, we will delve deep into the workings of central banks in forex trading, shedding light on their strategies, responsibilities, and significance.

Understanding Central Banks

Central banks are financial institutions responsible for managing a country’s money supply, interest rates, and currency stability. They act as the backbone of a nation’s financial system, contributing significantly to forex dynamics.

The Role of Central Banks in Forex

Central banks are key players in the forex market, where they execute several critical functions:

1. Monetary Policy Implementation

Central banks utilize monetary policy tools, such as interest rates and open market operations, to regulate money supply and influence exchange rates. By adjusting interest rates, they can encourage or discourage borrowing and spending, affecting currency values.

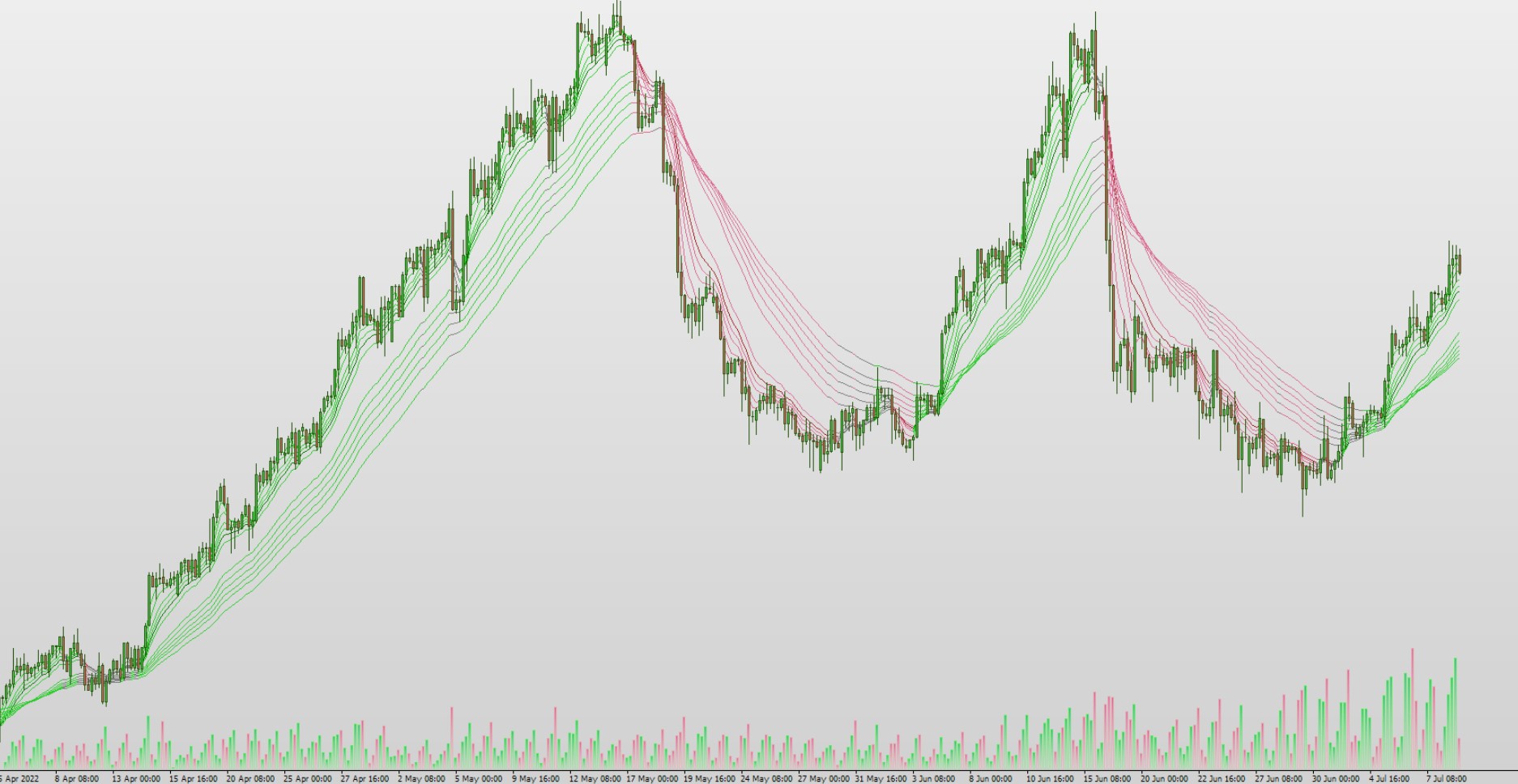

2. Currency Intervention

Central banks can intervene in the forex market to stabilize their currency’s value. This involves buying or selling their currency to counteract excessive fluctuations.

3. Foreign Exchange Reserves

Central banks maintain substantial foreign exchange reserves to ensure liquidity and provide stability during economic crises.

4. Economic Surveillance

Central banks monitor economic indicators and global events to anticipate and mitigate potential currency crises.

Strategies Employed by Central Banks

Central banks employ various strategies to manage forex markets effectively:

|

Strategy |

Description |

|

Forward Guidance |

Central banks provide clear signals about their future monetary policy decisions. This guidance helps guide market expectations and reduces uncertainty among investors and traders. |

|

Interest Rate Policies |

Central banks adjust interest rates to influence the level of foreign investment in their country. Higher interest rates can attract foreign capital, increasing demand for the domestic currency, while lower rates can have the opposite effect. This, in turn, impacts currency demand and exchange rates. |

|

Quantitative Easing |

Quantitative easing (QE) is a strategy where central banks purchase financial assets, typically government bonds, to inject liquidity into the financial system. This stimulates economic growth by lowering long-term interest rates and encouraging borrowing and spending. QE can also impact exchange rates by influencing the supply of a country’s currency. |

These are some of the key strategies central banks employ to effectively manage forex markets and maintain control over their respective currencies.

Central Banks and Exchange Rate Regimes

Central banks have the flexibility to operate under various exchange rate regimes, each with its distinct characteristics and implications for the currency’s value. One such regime is the Fixed Exchange Rate, where the value of a nation’s currency is tightly pegged to another, often a more stable currency, like the US dollar or the euro. This pegging is designed to provide stability and predictability to international trade and investment. Central banks under this regime commit to maintaining the fixed exchange rate by buying or selling their currency as needed in the foreign exchange market.

In contrast, central banks can also opt for a Floating Exchange Rate regime. Under this system, currency values are primarily determined by market forces of supply and demand. Central banks in this regime typically intervene in the foreign exchange market only when they deem it necessary to stabilize their currency or counteract excessive volatility. Floating exchange rates offer flexibility and allow currencies to find their natural value based on market dynamics.

The choice between fixed and floating exchange rate regimes reflects a country’s economic goals and the level of control it wants over its currency’s value. These decisions have significant implications for international trade, capital flows, and a nation’s overall economic stability.

FAQs

Q: How do central banks impact forex trading?

Central banks influence forex markets through monetary policy, currency intervention, and economic surveillance.

Q: What is the role of interest rates in forex?

Interest rates set by central banks can attract or deter foreign investment, affecting exchange rates.

Q: How do central banks stabilize their currencies?

Central banks maintain foreign exchange reserves and intervene in the market to counteract excessive currency fluctuations.

Q: What is forward guidance?

Forward guidance involves central banks providing clear signals about future monetary policy decisions to guide market expectations.

Q: Can central banks stimulate economic growth through forex strategies?

Yes, quantitative easing is one strategy central banks use to stimulate economic growth, impacting exchange rates.

Q: What are the two main exchange rate regimes?

Central banks can operate under fixed or floating exchange rate regimes, each with its characteristics.

Central banks are pivotal players in the forex market, wielding significant influence over currency values and global financial stability. Understanding their roles, strategies, and responsibilities is essential for anyone looking to navigate the complex world of forex trading.