In the dynamic world of financial markets, traders are constantly seeking reliable tools and strategies to confirm trends and make informed decisions. One such indispensable tool is the use of moving averages. In this comprehensive guide, we will delve deep into the realm of trading with moving averages and explore strategies that can help you confirm trends effectively.

Trading with Moving Averages: Strategies for Trend Confirmation is not just about crunching numbers; it’s about understanding market sentiment, making informed predictions, and ultimately, enhancing your trading success. Let’s dive into the world of moving averages and discover how they can empower your trading journey.

The Fundamentals of Moving Averages

Trading with Moving Averages: Strategies for Trend Confirmation begins with understanding the basics. Before we explore advanced strategies, let’s grasp the fundamentals:

What Are Moving Averages?

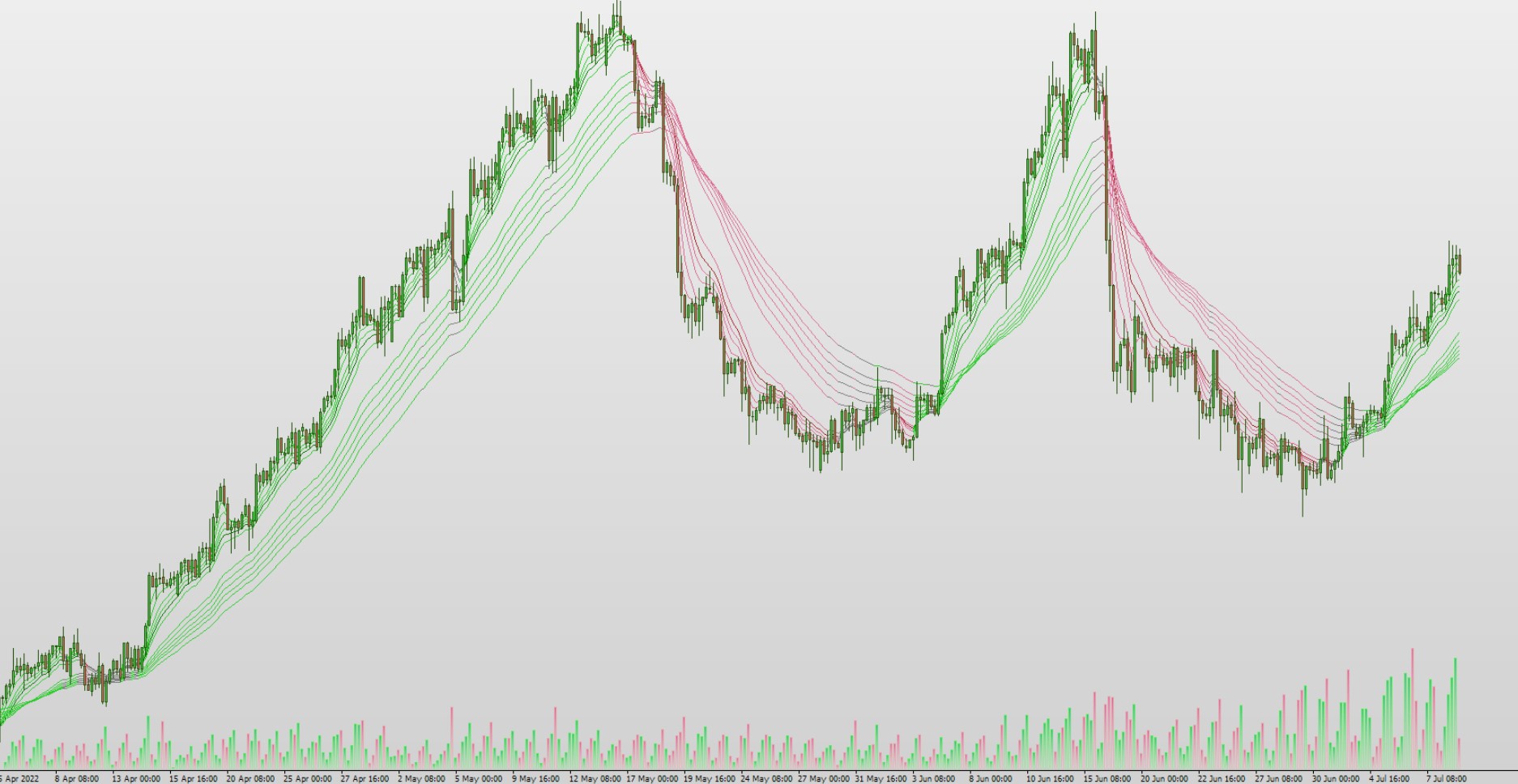

Moving averages are fundamental tools in the world of finance and trading. They are statistical calculations that examine a series of data points, often the closing prices of assets, over a specific duration. What sets them apart is their ability to simplify complex price data into a single, continuous line. This streamlined representation makes it considerably more manageable to spot and analyze trends within financial markets.

The process involves taking an average of the selected data points, creating a moving line that reflects the overall price movement over time. These moving averages can serve as powerful indicators for traders and analysts, helping them make informed decisions about buying or selling assets. By smoothing out the inherent volatility of financial markets, moving averages offer a clearer perspective on market trends and potential trading opportunities.

In essence, moving averages are invaluable tools for traders and investors, allowing them to cut through the noise of fluctuating prices and identify meaningful patterns that can guide their trading strategies. Whether you’re a seasoned trader or just entering the world of finance, understanding moving averages is a crucial step toward achieving success in the markets.

Types of Moving Averages

- Simple Moving Average (SMA): The SMA gives equal weight to all data points within the chosen period, providing a balanced representation of price movements.

- Exponential Moving Average (EMA): The EMA places more weight on recent data, making it sensitive to current price changes.

- Smoothed Moving Average (SMMA): SMMA considers all data within the chosen period but applies less weight to older data.

Choosing the Right Moving Average

Selecting the appropriate moving average depends on your trading style and objectives. SMA suits long-term traders, while EMA may be preferred by those seeking quick trend confirmations.

Strategies for Effective Trend Confirmation

Now that we’ve laid the groundwork, let’s explore various strategies for confirming trends using moving averages:

1. Golden Cross and Death Cross

- Utilize the SMA and EMA to identify these critical points.

- A Golden Cross occurs when the short-term EMA crosses above the long-term SMA, indicating a potential bullish trend.

- Conversely, a Death Cross happens when the short-term EMA crosses below the long-term SMA, signaling a possible bearish trend.

2. Moving Average Crossovers

- Experiment with different timeframes to spot crossovers that suit your trading style.

- Bullish crossovers involve the short-term moving average crossing above the long-term average, suggesting a buy signal.

- Bearish crossovers imply a sell signal when the short-term average crosses below the long-term average.

3. Support and Resistance

- Combine moving averages with support and resistance levels to confirm trends.

- When prices stay above both moving averages, it confirms an uptrend.

- Conversely, prices trading below both averages indicate a downtrend.

4. Divergence Confirmation

- Use moving averages to identify divergence between price and momentum.

- Bullish divergence occurs when prices make lower lows while moving averages make higher lows, indicating a potential reversal.

- Bearish divergence suggests a possible trend reversal when prices make higher highs while moving averages make lower highs.

FAQs

Q: How do I calculate the ideal period for a moving average?

A: There’s no one-size-fits-all answer. Experiment with different periods and choose the one that aligns with your trading goals.

Q: Can I use moving averages in cryptocurrency trading?

A: Absolutely. Moving averages are versatile and effective in various markets, including cryptocurrencies.

Q: What’s the significance of using multiple moving averages?

A: Multiple moving averages help you confirm trends from different angles, increasing the accuracy of your predictions.

Q: Are there mobile apps that provide moving average data?

A: Yes, numerous trading apps offer real-time moving average data, making it convenient for traders on the go.

Q: Do moving averages work well in volatile markets?

A: Yes, moving averages can be adapted to volatile markets by adjusting the periods to capture shorter-term trends.

Q: How often should I update my moving averages?

A: It depends on your trading style. Daily updates are common, but shorter-term traders might update more frequently.

Trading with Moving Averages: Strategies for Trend Confirmation equips you with the knowledge and tools needed to navigate the complex world of financial markets. By understanding moving averages and implementing these strategies, you can make well-informed trading decisions.

Remember, success in trading requires continuous learning and adaptation. Stay informed, practice diligently, and trust your instincts. Happy trading!